CM Punjab Loan Scheme 2025 Online Apply | Complete Guide for Pakistan

In 2025, the Government of Punjab introduced the CM Punjab Loan Scheme under the Chief Minister’s Rozgar Program, aiming to empower youth and small business owners. Through this initiative, individuals can access interest-free or low-markup loans to start or expand their businesses.

The scheme aligns with the government’s broader vision of economic revival and self-employment, ensuring financial inclusion and growth in every district of Punjab.

What Is the CM Punjab Loan Scheme 2025?

The CM Punjab Loan Scheme 2025, also known as the Punjab Asaan Karobar Card, provides easy access to finance for skilled youth, entrepreneurs, and existing business owners.

This program enables individuals to apply for loans ranging from PKR 100,000 to PKR 10 million, depending on the project’s scale and nature. The financing is supported by Punjab Small Industries Corporation (PSIC) and Bank of Punjab (BOP).

Key Objectives of the Scheme

- Promote entrepreneurship and job creation

- Support SMEs (Small and Medium Enterprises)

- Reduce unemployment by encouraging self-employment

- Facilitate women entrepreneurs and youth innovators

- Provide interest-free or subsidized loans to deserving individuals

Loan Categories Under the Program

The scheme offers three main categories based on business size and financing needs:

| Category | Loan Amount (PKR) | Markup Rate | Repayment Period |

|---|---|---|---|

| Tier 1 (T1) | 100,000 – 1 million | 0% | Up to 3 years |

| Tier 2 (T2) | 1 million – 5 million | 4% | Up to 5 years |

| Tier 3 (T3) | 5 million – 10 million | 5% | Up to 7 years |

Note: The government pays the markup subsidy directly to the bank, making the scheme affordable for all applicants.

Eligibility Criteria

To apply for the CM Punjab Loan Scheme 2025, applicants must meet the following requirements:

- Must be a resident of Punjab

- Age between 21 to 45 years

- Possess a valid CNIC

- Must have a viable business idea or existing business

- For agriculture and solar projects, land ownership or lease agreement may be required

- Women, transgender persons, and differently-abled individuals are encouraged to apply

Documents Required

Before applying online, keep the following documents ready:

- Copy of CNIC

- Recent passport-size photographs

- Business plan or feasibility report

- Educational or technical certificates (if applicable)

- Utility bills (proof of residence)

- Bank account details

- Collateral documents (for higher loan tiers)

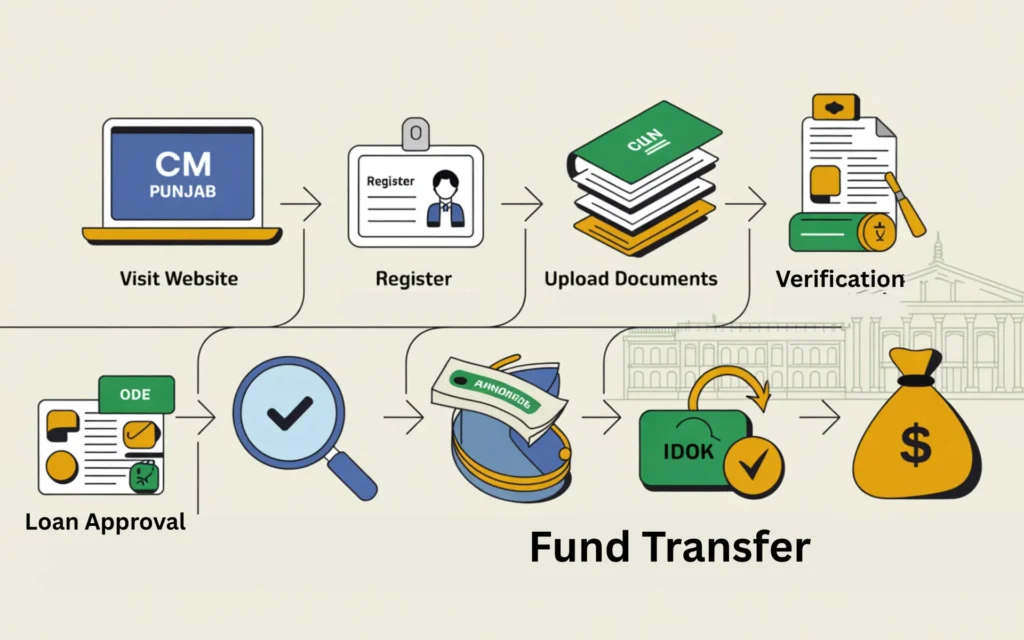

How to Apply Online for CM Punjab Loan Scheme 2025

Follow these simple steps to apply online:

- Visit the official Punjab Rozgar Program portal: https://rozgar.psic.punjab.gov.pk/

- Click on “Apply Now”

- Fill out the online form with accurate personal and business information

- Upload the required documents in PDF or JPEG format

- Review and submit your application

- You’ll receive a confirmation SMS or email once your application is processed

After approval, the Bank of Punjab (BOP) will contact you to finalize documentation and disburse the loan.

Punjab Asaan Karobar Card – Key Feature

The Punjab Asaan Karobar Card is a digital identification and financial facilitation card linked to your approved loan. It helps in:

- Easy repayment tracking

- Access to business support resources

- Eligibility for government subsidies and training programs

Special Focus: Solar Energy and Green Businesses

The Punjab government strongly encourages applications for renewable energy projects. Entrepreneurs who wish to install solar systems for commercial or agricultural use can apply under this scheme.

For example, if you plan to set up a 2kW or 5kW solar system, you can avail financing support under Tier 1 or Tier 2 categories.

🔗 Related Reads :

Repayment and Grace Period

Repayment schedules are flexible and depend on the loan tier. Borrowers can benefit from a grace period of 3 to 6 months before repayments begin. Payments can be made monthly, quarterly, or semi-annually through the Bank of Punjab.

Failure to repay within the due date may result in penalties or disqualification from future government programs.

Success Stories

Many small business owners and youth across Punjab have already benefited from this initiative. Examples include:

- Sara from Multan, who started a home-based clothing business with a PKR 500,000 loan.

- Ahmed from Faisalabad, who launched a small solar installation company using Tier 2 funding.

- Zeeshan from Lahore, who expanded his auto parts workshop under the Punjab Asaan Karobar Card.

Benefits of CM Punjab Loan Scheme 2025

- Interest-free or low-markup loans

- Simple online application process

- Equal opportunity for men and women

- Encourages green and renewable businesses

- Strengthens Punjab’s local economy

Helpline and Contact Information

For assistance or inquiries:

📞 Helpline: 042-9920 5222

🌐 Website: https://rozgar.psic.punjab.gov.pk/

🏢 Address: Punjab Small Industries Corporation (PSIC), Lahore

Conclusion

The CM Punjab Loan Scheme 2025 is a promising step towards building an economically empowered Pakistan. By providing easy and affordable access to finance, the government is paving the way for innovation, employment, and sustainable business growth.

If you are a young entrepreneur, skilled worker, or small business owner, this is your chance to turn your dream into reality. Apply today and take the first step toward financial independence.

FAQs

How do I apply for the Assan Karobar Finance Scheme 2025?

Visit rozgar.psic.punjab.gov.pk and click “Apply Now.” Complete the online form, upload your documents, and submit your application. The Bank of Punjab will contact you after approval.

How to apply for Maryam Nawaz 3 Marla Plot Scheme?

Applicants can apply through the Punjab Housing & Town Planning Agency (PHATA) website when applications open. The scheme aims to provide affordable housing for low-income families in Punjab.

How to apply for a CM Punjab loan?

You can apply online via the Punjab Rozgar Program website. Fill in accurate personal and business information, attach required documents, and wait for the verification process.

What is the deadline to apply for the loan?

While no fixed deadline has been announced for 2025, early applications are recommended as funds are released in phases across districts.

Who is eligible for the CM Punjab House Loan Scheme?

All residents of Punjab aged 21–45 with a valid CNIC and no history of loan default can apply. Priority is given to first-time applicants and low-income groups.

What is the Apni Chhat Apna Ghar Scheme in Punjab?

This is a low-cost housing program launched by the Punjab government to provide affordable homes to low-income families under easy installment plans.

7. What is the purpose of a BOP loan?

The Bank of Punjab (BOP) provides financing under government initiatives to promote entrepreneurship, business expansion, and employment across the province.